Monthly compendium of biosciences industry perspectives, January 2018

US secures national investments after Pfizer mega merger attempt to evade taxation

After the risk in 2016 of US tax base erosion with a loss of 2 billion per year only for this merger, US government has strengthened law in order to keep at home corporate who are massively benefiting from public investment. It was the case of the pharma giant which benefits from universities, healthcare system and US research effort. Other High-profile firms in the medical sector such as Medtronic, Salix, AbbVie, Mylan and Hospira were on the track to relocate headquarter outside US (CRS Report, August 17, 2017). Without tax/work borders headquarters seem to end up in Bermuda and jobs & factories in Asia which hampers public services’ funding such as hospitals, justice, and security. The current Tax reform is bound to boost in the long-run GDP by 1.7 percent and increase the domestic capital stock by 4.8 percent (Tax Foundation model December 2017). As a matter of fact, Apple is about to bring home 38 billion in the federal budget from foreign cash taxes (Reuters January17th 2018).

A patent published on January 4th 2017 to graft a brain in a cloned body in order to extend life expectancy.

This patent “Method for realizing human rebirth by adopting human cloning and brain transplantation” (CN 106264624 A patent), paves the way of a new era where human cloning is possible and where designed body could be the shell of the conscience of a human being materialized by the brain. It reminds of the cryogenization dream, where people hope to come back to life after being frozen. It raises major ethic question concerning the status of the body. In latin law use for money or patent of human body consists in a major offense to human dignity, in EU law human cloning process is not patentable (EU 98/44/CE 6 July 1998 Article 6). This invention echoes to the movie The Island (Michael Bay, 2005). This patent filing shows also that research in China is at the forefront of this bioethical controversy.

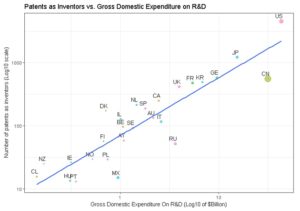

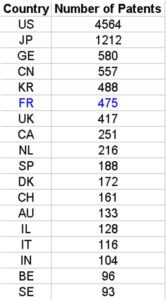

OECD Biotech patents in 2013, clear correlation between expenditure in R&D and patent filing

We have studied the top world countries from which an originated inventor filed a biotech patent as main technology class, under PCT (Patent co-operation treaty, OECD current data), at international phase in 2013. There is a log linear relation between the number of filed patents and the gross domestic expenditure on R&D. (Pearson correlation test cor = 0.8961566 95, percent confidence interval: 0.7826889 0.9519739, t = 10.098, df = 25, p-value = 2.634e-10). Hence, rather than GDP, GDE on R&D predicts better the outcomes in term of number of filed patents in biotechnology. We do see China as a serious challenger, having a massive GDE on R&D and an amount of filed patent similar to Germany (Third world rank). France performed well in 2013 for Biotech patents filing (6th world rank and 2nd rank in Europe).

Project of EU regulation on drug pricing is on the way

In 2017, a study published in the British Medical Journal reported that most cancer drugs recently entering the European market do so without clear evidence of extending or improving quality of life. Since then, policy makers are reflecting upon current EMA’s practices. By the end of January 2018, European Commission’s health department,will submit a proposal to coordinate how countries measure the value of new medicines (value based pricing) according to general Health Technology assessment framework (HTA). EMA may collaborate also at a european level with national HTA bodies, to help decide whether to pay for a treatment. This policy change will raise questions with respect to harmonization of drug pricing, local versus european regulation, and potential more stringent depedency on HTA regulation for pharma companies (Politico January 17th 2018).

Biosciences’ Mergers and Acquisitions boost planned for 2018

According to an Healthcare sector report from BakerMcKenzie, we may anticipate a boost in M&A activity to rise to USD 418 billion (250.2 billion, 104.8 billion and 55.1 billion in US, Europe and Asia respcetively), hence up 50% from USD 277 billion in 2017. Former year was put under the potential riks of Brexit and US tax reform. In 2018, upcoming deals may confirm strategic moves toward outsourced innovative drug candidates, blockbusters hopefully. Current US tax reform which proposes a relocation of overseas earning at a 15.5 % tax rate, may also provide incentive for big pharmas to invest their foreign/offshore cash in M&A and IPO transactions. EY predicts also the development of shareholders’ activism in Europe and Asia, as a key strategy driver.

Le Belvédère, January 23rd 2018