Monthly compendium of biosciences industry perspectives, February 2018

When a cluster needs a keystone player

With the hectic hype of clusters’ creation to foster innovation, it is sometimes good to come back to reality. We looked at a patent report regarding Australian medical devices (Australian Patent analytics report 2014) and it is indisputable to note that keystone players, which means implanted players in the innovation field, are the true catalysts of inventions. This report shows that long term collaboration between local research and industry is the only way to success. Cluster as an open field with intermittent partners is bound to be a branding masquerade. Without keystone players who reciprocate it is like pouring money and intelligence into the abyss. Current legislative landscape tends to comfort this wrong impetus, where unfair techno-vultures cherry-pick long term research nuggets. It is worrying that EU is less than capable to stem the tide of this economic drain. The union has no safety net concerning industry M&A (Kuka acquisition, DW June 1st 2017), tax evasion (Panama unblacklisted, Reuters January 23rd 2018) and market caveats (CE mark weakness, Icom uk 2010). Vulpine companies are gaming the system despoiling tax incentives, public investment & free work from universities. That trend leads to an unsustainable innovation culture where good fortune is captured instead of being reinvested into the ecosystem.

The platinum pill

With Luxturna marketed with a price of $425,000 per eye ($850,000 for both eyes) it raises concerns about acceptability of innovation price model (Reuters, January 12th 2018). Regarding specific technology and very low prevalence, innovation leads to high prices. This trend is major with numerous drugs exceeding $500,000 cost per patient (Motley Fool, April 18th 2017):

- Glybera one unique curative injection $1 million

- Ravicti annual cost per patient of nearly $794,000

- Spinraza costs for the first year of treatment $750,000

- Lumizyme costs annually more than $626,000

- Carbaglu is priced per year per patient at more than $585,000

- Actimmune is priced per year per patient at more than $572,000

- Soliris has an annual price tag per patient of nearly $543,000

But high prices also happen for current marketed drug (Daraprim increase from $13.50 to $750, New York Times, September 20th 2015) or for simple drug or device with dramatic impact on healthcare system (valve replacement rebills savings on standard surgery, MDCJV 2012 ).

Currently US government has the project to make a law to counter this trend of high priced drugs after controversy to things like the $1,000 Sovaldi pills, or the price of life-saving EpiPens being raised to nearly $500 from $60 (Los Angeles Times, Feb 1st 2018). A lobbying strategy to undermine the government project has been set-up by main business players in the field (Medcity news, Feb 5th 2018).

European Commission proposal on joint Health Technology Assessment

The European Commission has proposed joint health technology assessments (HTA) of new drugs and medical devices, to determine if they offer value for money and should be prescribed for patients. Health Technology Assessment (HTA) is a multidisciplinary process that summarizes information about the medical, social, economic and ethical issues related to the use of a health technology in a systematic, transparent, unbiased and robust manner and provides recommendations whether health products should be financed or reimbursed by the healthcare system in a given country or region.

A joint assessment is a structured information for rapid or full/comprehensive HTAs which is the output of joint production in which 2 or more countries and/or organizations work together to prepare shared products or agreed outcomes. Several joint assessments have already been released by the European Network of Health Technology assessment since 2010. European Medicine Agency and Medtech Europe are key stakeholders for such joint effort.

A draft bill published last month would address the current issues for HTA, such as scattering of resources, redundancy of national approaches to HTA, and limited transparency for patients, which limitate market access for innovation. Today, pharma companies and device manufacturers are required to submit evidence to different agencies in different countries to get their products reimbursed. The joint clinical assessments for HTA purposes will only be completed after the products have obtained a marketing authorization.

The proposal includes provisions for the use of common HTA tools, methodologies and procedures across the EU.

The Commission has proposed 10 to 15 assessments in the first year of operation, rising to around 65 joint clinical assessments towards the end of a transitional period. Governments would have three years to put the regulation into national law after approval by the European Parliament and European Council.

Biotech patents: Focus on Relative Specialisation Index

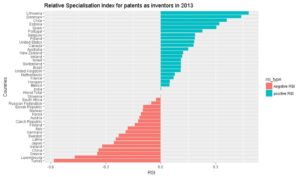

We have studied the top world countries from which an originated inventor filed a biotech patent as main technology class, under PCT (Patent co-operation treaty), at international phase in 2013. Source data: OECD

The Relative Specialisation Index (RSI) is a measure to account for how specialised a country is in a particular technology area. The RSI compares a country’s fraction of the total number of biotech patents filed across all countries, with its fraction of the number of patents across all technologies. The formula is given below:

where: ni is the number of biotech patents from country i

ntotal is the number of total biotech patents over the time period

Ni is the total number of patents across all technologies from country i

Ntotal is the total number of patents across all technologies over the time period

The RSI accounts for the fact that some countries, like US, Japan and China, file more patent applications than others. The RSI enables to put the light on countries that have a greater level of patenting in a given area than expected from their overall level of patenting, and which would otherwise remain under the radars. RSI is equal to zero when the country’s share in a given technology field is equal to all patents filed in all fields (no specialisation), and positive when a specialisation is observed.

Although USA, Japan and Germany were the top three countries from which inventors filed a PCT patent in 2013 for biotech, only USA remains among specialised countries. Japan and Germany have both a negative RSI.

Among the top 18 countries having filed patents as inventors, we recover Belgium, Canada, Israel, Australia, Switzerland, UK, France and Netherlands as having a positive RSI. On the contrary, Japan, China and Korea do have negative RSIs.

Le Belvédère, February 19th 2018